Developing countries' access to CbCR: Guess who's (not) coming to OECD dinner - Financial Transparency Coalition

Rogers: EU/OECD's Real Concern About CIPs Is Tax Competition, Not "Good Governance" - Part 1 - Investment Migration Insider

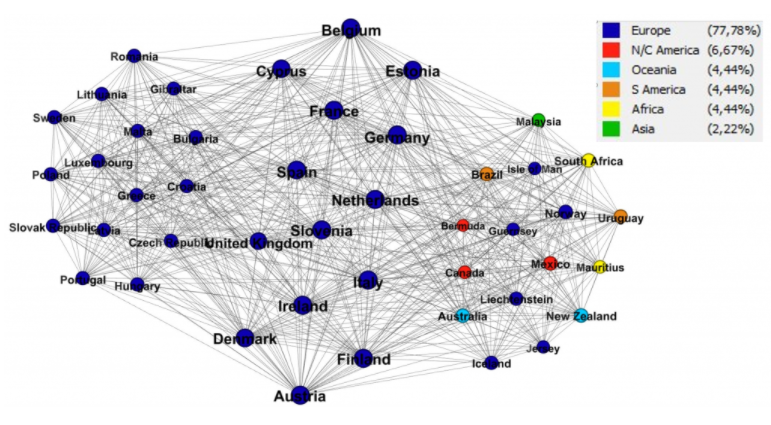

OECD Agreement on Automatic Exchange of Financial Information Signed by 13 Countries during Recent Global Forum on Tax Transparency Meeting — Orbitax Tax News & Alerts

OECD Tax on Twitter: "How are countries implementing the #BEPS Action 5⃣ standard for the exchange of information on #tax rulings? 🟢 81 jurisdictions fully in line 🟡 43 jurisdictions receive one

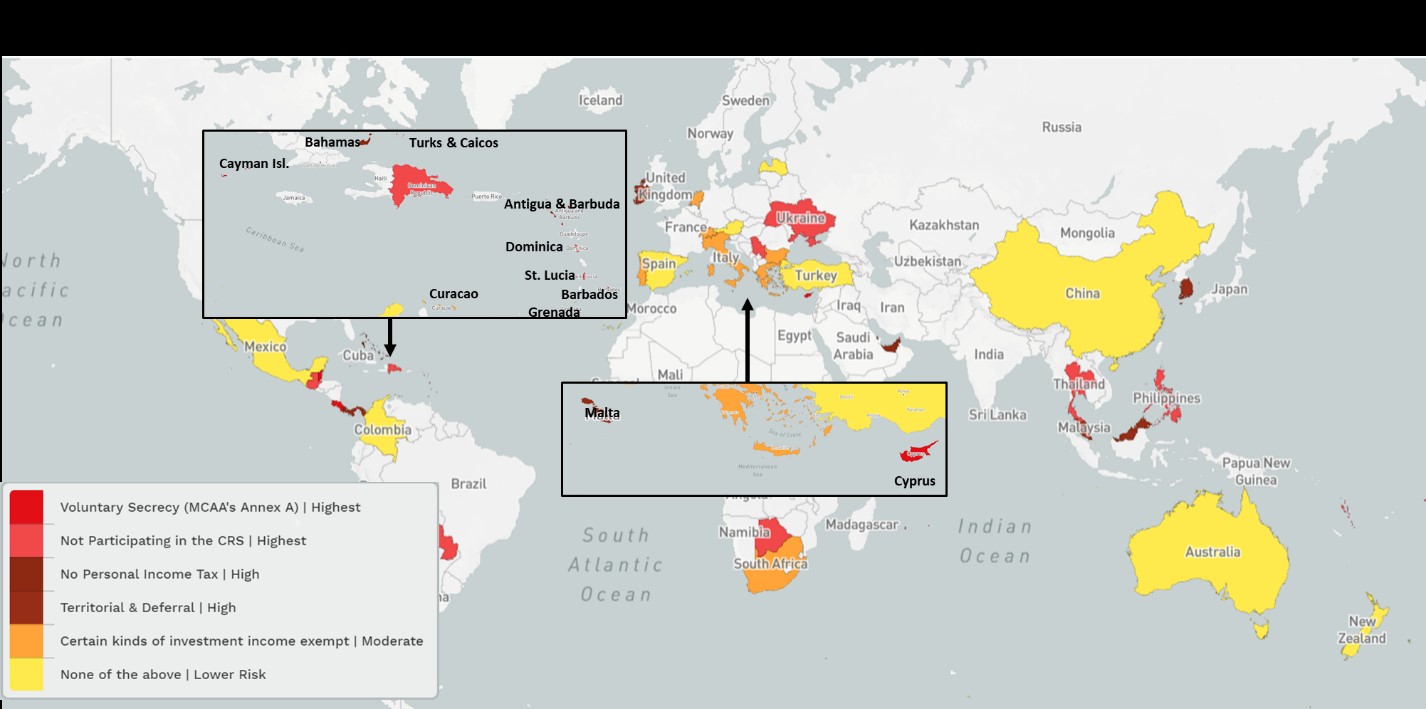

Now you see me, now you don't: using citizenship and residency by investment to avoid automatic exchange of banking information - Tax Justice Network

Automatic Exchange of Information January 2016 Introduction Cyprus – An early adopter of the Automatic Exchange of Informati

A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations